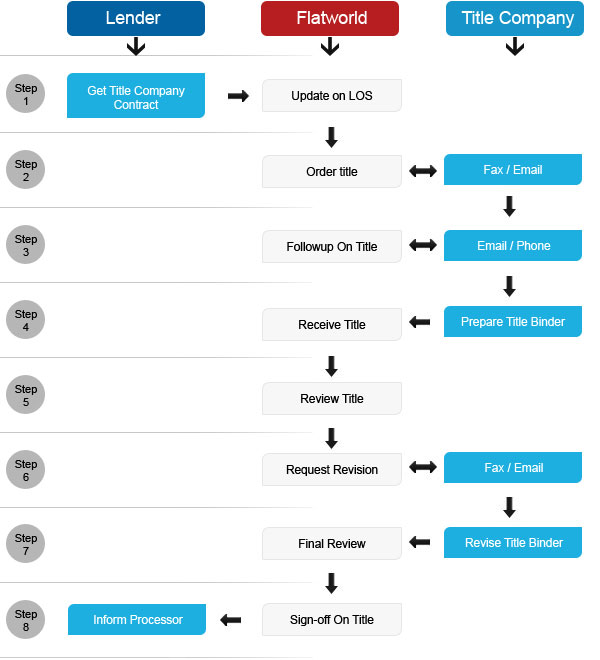

Flatworld Solutions handles the complete Title Process for mortgage lenders and brokers. The process starts right after the loan officer provides the title or escrow contact for the loan file.

We place an order with the title company via fax or email, and get an order confirmation to ensure that it has been received and will be processed. The title company then tells us when we can expect to receive the title binder, and we follow up with them in case we do not receive it by then.

Once we receive the title binder, we review it for correctness and completeness, including ICL, E&O, COT and the Purchase Contract (in case of vesting). We request revisions (if required) and sign off on the title once everything is in order. We then send an email to the processor and loan officer to inform them that the title condition has been signed off on.

Contact us to outsource your title processing

Contact UsOur Customers

Case Studies

-

Flatworld's Automated Solution - MSuite Reduced Loan Closing Time Significantly for a US Client

-

FWS Used its Tool, MSuite, to Enable a Leading Mortgage Company Streamline its Processes

-

FWS Used its Tool, MSuite, to Enable a Leading Mortgage Company Streamline its Processes

-

FWS Automated the Data Indexing and Extraction Process Using its Tool, MSuite, For a Top Mortgage Company

-

Flatworld Automated Underwriting Processes for a Leading US Residential Lender

USA

Flatworld Solutions

116 Village Blvd, Suite 200, Princeton, NJ 08540

PHILIPPINES

Aeon Towers, J.P. Laurel Avenue, Bajada, Davao 8000

KSS Building, Buhangin Road Cor Olive Street, Davao City 8000