Are you looking for a solution that makes your mortgage lending process cheaper, faster, and better? Are you struggling to identify and leverage the right amalgamation of technology and automation to make your mortgage lending process more efficient? Are you finding it difficult to set aside the right amount of time, money, and effort into leveraging technology and automation because you are not clear about what you want to achieve? If so, you stand to benefit significantly from our mortgage automation support services.

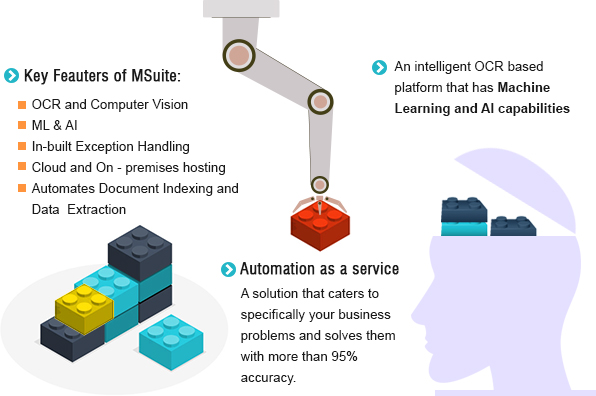

Flatworld Solutions (FWS) is a leading mortgage automation company and has served over 100 lenders/servicers over the last decade. We have a thorough understanding of the ground reality in the mortgage industry and have developed a proprietary platform called MSuite, which is a state-of-the-art automation engine leveraging AI and OCR technologies, among others, to serve the mortgage industry. Our MSuite platform is highly scalable, accurate, quick, flexible, and results in significant cost savings for our clients.

Mortgage Automation Support Services We Offer

Our mortgage team of automated mortgage underwriting solutions experts comprises some of the most talented and skilled individuals who are trained to handle any of the client's requirements. As a leading provider of mortgage automation support services in India, we leverage the power of our MSuite automation tool, which has the following 5 components that aid in automating different tasks.

Connector

We designed this component to be able to receive inputs from various information sources. Some of the sources that MSuite can receive information from includes -

MSuite can receive information from emails and process it further. If an email has transactional information in the body, MSuite can take this information. If the email has information that triggers other actions, MSuite can read this information and, if needed, can connect with other systems and then process relevant transactions. For instance, if an email is generated due to a new document being uploaded into the LOS/servicing system, MSuite can monitor the email and address the transaction that requires processing.

API Integration

MSuite can receive transactional input through APIs from a wide variety of sources, including servicing systems, LOS, 3rd party vendor systems, and other internal/external systems.

SFTP

MSuite can monitor and track folders in SFTP and begin processing relevant items that have been uploaded there.

Direct Uploads

MSuite also has a provision for users to directly upload transactions that require processing.

Indexing Engine

MSuite's indexing engine has been designed to be robust and address real-world document quality issues. The indexing engine can recognize over 350 types of documents and even those with varied formats. Using a combination of OCR, machine learning, and computer vision, MSuite can classify documents (including those with lower scan quality of up to 150 DPI). This fully automated workflow has an accuracy of over 95% and is one of the best in the industry.

Data Extraction Engine

Lenders/servicers routinely extract data from a variety of documents (collateral, asset, income, closing docs, etc.) to store that data in a digital format on their systems. Accuracy is extremely important here as wrong or incomplete information can hamper the origination/servicing process. MSuite provides over 98% accuracy in data extraction. Exception handling is also provided when data points have an OCR confidence score of less than 90%. However, with digital data, the accuracy is always 100% and there is no need for exception handling.

Rule Engine

MSuite can perform several QA revies and other complex tasks, such as upfront underwriting of files and income calculation. It has an in-built and dynamic rule engine that can seamlessly manage thousands of rules. It is easy to maintain and update according to evolving regulatory requirements and changing business needs. MSuite's rule engine currently can automate many different tasks and thoroughly review files acquired for services and underwriting of specific loan types.

Reporting Engine

MSuite provides detailed and comprehensive reports and trend analyses of all the automated tasks, which is important to track the performance of several distinct parameters. As a top mortgage automation support service providing company, we provide both standard reports as well as customized reports and MSuite can report on almost every data point stored in the system.

MSuite Implementation Infographic

Why Choose FWS for Mortgage Automation Support?

We have catered to the needs of global mortgage companies for over a decade and precisely understand the needs of the client. Outsourcing mortgage automation services to us can help you take advantage of the following benefits -

Information Security

We are an ISO/IEC 27001:2022 ISMS certified organization and you can be assured that all your data is completely safe with us.

Affordable Pricing Options

We provide our clients with highly flexible pricing options and they have to pay only for the services they have opted for the resources used.

Quick Turnaround Time

We have multiple delivery centers spread across time zones which enable us to deliver services within a quick turnaround time without compromising on the quality.

Best Infrastructure

We have access to state-of-the-art infrastructure in terms of international standard office spaces and tools and technologies, and uninterrupted network connections.

Experienced Team

We have a highly qualified, skilled, and experienced team of mortgage experts who can help you with all your mortgage automation requirements.

Single Point of Contact

We assign a dedicated project manager when you outsource to us who will be a single point of contact for all your queries and issues.

24/7 Availability

Our sales team, project managers, and call center executives are always available to address your issues via phone or email.

High-quality Automation Services

We are an ISO-certified organization. Hence, you can rest assured that we will deliver only the best quality services to our clients.

Ease of Scalability

Our team of mortgage experts is well equipped to scale up the services we provide as and when the requirements of the client increases.

Outsource Mortgage Automation Support Services to Flatworld Solutions

Flatworld Solutions has been a pioneer in providing high-quality mortgage automation services and a plethora of other mortgage support services to its global clientele. Our team comprises some of the most qualified and experiencedto its global clientele. Our team comprises some of the most qualified and experienced mortgage experts who can provide you with end-to-end solutions and help you in automating your mortgage processes. Having been serving global mortgage clients for 20 years now,we have gained enough experience to cater to the needs of the client with ease. IF you are looking for a reliable, efficient, and cost-effective mortgage automation service provider, then you have come to the right place. In addition to mortgage automation, we also offer RPA for Mortgage Processing to streamline the rate and quality of the application process.

To start outsourcing mortgage automation support services, get in touch with us today!

Our Customers

Case Studies

-

Flatworld's Automated Solution - MSuite Reduced Loan Closing Time Significantly for a US Client

-

FWS Used its Tool, MSuite, to Enable a Leading Mortgage Company Streamline its Processes

-

FWS Used its Tool, MSuite, to Enable a Leading Mortgage Company Streamline its Processes

-

FWS Automated the Data Indexing and Extraction Process Using its Tool, MSuite, For a Top Mortgage Company

-

Flatworld Automated Underwriting Processes for a Leading US Residential Lender

USA

Flatworld Solutions

116 Village Blvd, Suite 200, Princeton, NJ 08540

PHILIPPINES

Aeon Towers, J.P. Laurel Avenue, Bajada, Davao 8000

KSS Building, Buhangin Road Cor Olive Street, Davao City 8000