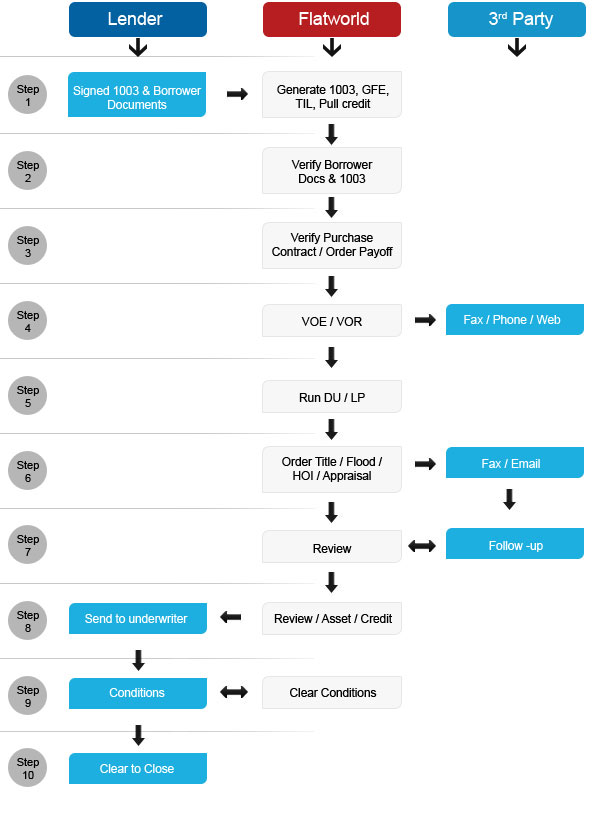

Our processing team starts working on the loan immediately after receiving the signed Form 1003 and other necessary documents from the loan officers. The team checks for the correctness and completeness of the initial submission package, comprising the 1003, Asset, Income, Credit and other disclosures. We verify the name, signature and dates on each of the documents. All the 3rd-party verifications are done via phone, email and fax. Our team also orders the Title, Flood Certificate, HOI and Appraisal and follows up with the respective parties to obtain each of these documents on time. We review them and request revisions as required. We run DU/ LP and sign off on each of the conditions before sending the loan to the underwriters.

Contact us right away to outsource your mortgage loan processing requirements.

Contact UsOur Customers

Case Studies

-

Flatworld's Automated Solution - MSuite Reduced Loan Closing Time Significantly for a US Client

-

FWS Used its Tool, MSuite, to Enable a Leading Mortgage Company Streamline its Processes

-

FWS Used its Tool, MSuite, to Enable a Leading Mortgage Company Streamline its Processes

-

FWS Automated the Data Indexing and Extraction Process Using its Tool, MSuite, For a Top Mortgage Company

-

Flatworld Automated Underwriting Processes for a Leading US Residential Lender

USA

Flatworld Solutions

116 Village Blvd, Suite 200, Princeton, NJ 08540

PHILIPPINES

Aeon Towers, J.P. Laurel Avenue, Bajada, Davao 8000

KSS Building, Buhangin Road Cor Olive Street, Davao City 8000