Are you facing a cash crunch in your organization and unable to derive the intended output from the amount spent on the receivables? Or, are you going through the bad debts due to unsystematic invoicing, and dearth of invoicing data entering professionals? If, yes, then, you must outsource accounts receivable factoring services to an expert like Flatworld Solutions.

FWS is among the leading provider of support services of accounts receivable factoring companies with over 20 years of service experience in the streamlining the accounts receivable factoring process of several industries and verticals. Our accounts receivable factoring experts along with our team of receivable funding specialists can improve the collections, enter invoices, collate cash receipts, reduce delays, etc.

What Is Accounts Receivable Factoring?

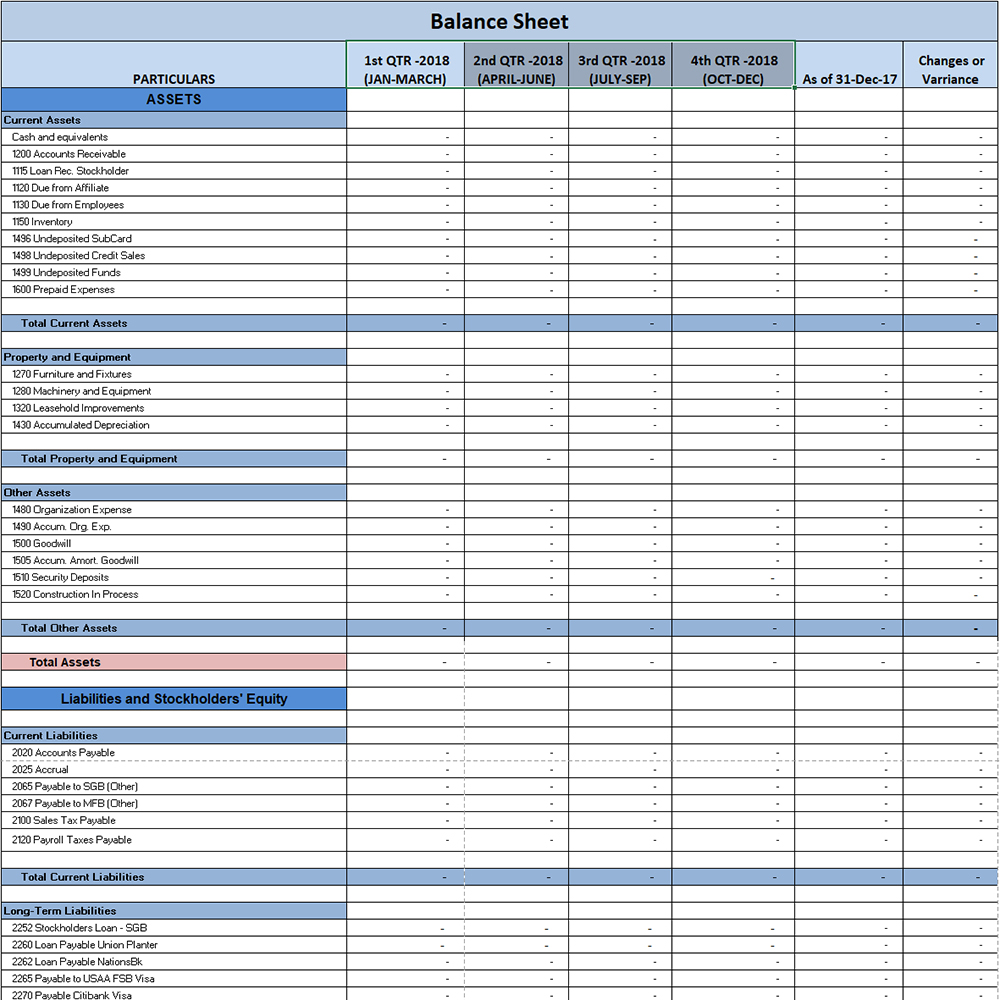

Accounts receivable (AR) factoring, otherwise known as receivable funding is simply a type of business funding, in which the company can sell its outstanding accounts receivable to a factoring company to obtain a decided capital. This way the company can finance/re-finance their accounts receivables to keep a working capital and maintain it as the current asset on the balance sheet.

So, what is a factoring company? Factoring can influence both the income and the balance sheet of your company as AR is the chief business asset. The main reason for opting for factoring is its immediate effect on the balance sheet, it can boost the balance sheet by converting the AR into immediate cash. It cuts the issue of timing - "When will the company receive invoice payment?" is essentially eliminated here.

To sum up, factoring, or more precisely, the Factoring company is behind the increased cash flow. Thus, it is possible to grow with an immediate help from the fasting company with an adequate cash flow.

What Are the Accounts Receivable Factoring Services We Offer?

When you outsource accounts receivable factoring services to us, we can help you significantly improve the collections and support you in streamlining the cash collection process from order to payment. Through our accounts receivable factoring solutions, we can deliver a thorough analysis of your current AR factoring process with a better process to report, communicate with the customers and the factoring company. A few of the accounts receivable factoring services that we offer include -

Invoice Factoring

We have an expert team AR team which can create/streamline the invoices. It can be done based on the sales order receipts, product delivery copies, confirmation copies, etc. Our team can also upload the invoices into the system.

Factoring Receivables

Under our accounts receivable finance factoring services, our team can follow up with the customers for the required collection, and check the amount, time, etc. of the collection done. Our expert accounts receivable factoring team can create the cash-flow summary in & out of your organization.

Account Receivable Financing

We can prepare and send the account receivable statements. Moreover, we can update the invoice information in the account receivables and update factoring of the AR.

Invoice Data Entry

Our team of experienced data entry professionals can enter/upload invoices & electric invoices into the system. This will help you have an accurate and updated information on all the accounts and arrears.

AR Loan Processing

We can assist you in the account receivable loan processing as well. Our AR support team can take care of all the back-office support needs and can also order/re-order all the invoices, electronic-invoices, etc. that would help you get the AR loan.

Is Accounts Receivable Factoring Suitable for Your Company?

Since AR is an essential element in a company's balance sheet, it acts as an important asset that can be converted to cash at the due time, which is usually 30, 60, or 90 days. However, because of some tardy customers who do not pay on time, the company might have to write off the AR on their balance sheet. This will, in turn, bring a great amount of loss. Hence, accounts receivable factoring can be the only savior in such a case.

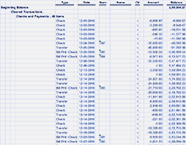

Our Accounts Receivable Factoring Process

At FWS, we make sure that you get compliance friendly accounts receivable factoring services through our wide-ranging AR back-office support solutions. We can help with your invoices, document the customer services information, save time, etc. Basically, we will work as an extension of your finance department. The process that we follow are -

Gathering & Collating Invoices

Documenting all the Customer Services Process, and uploading the Invoice information into your system

Updating account receivables statement

Escalating the short payments

Create and send the account statements

Prepare cash flow summary

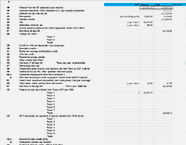

Our Finance and Accounting Portfolio

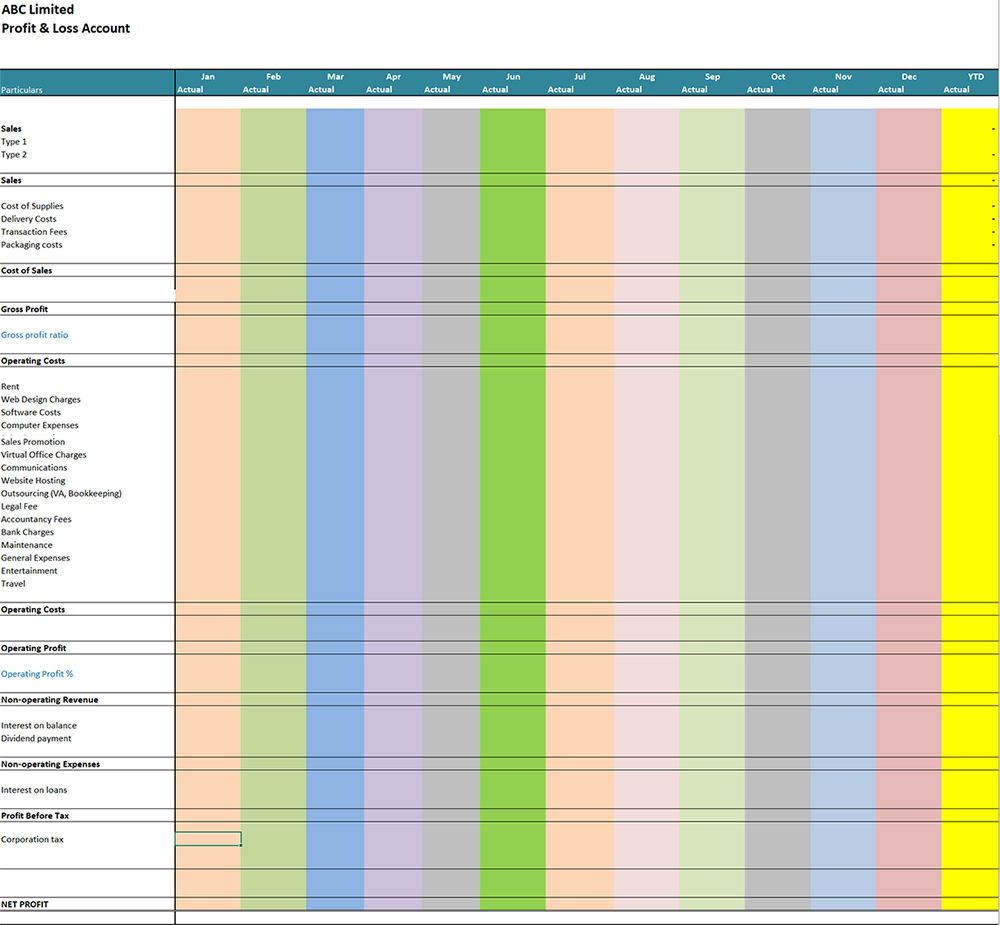

Accounting

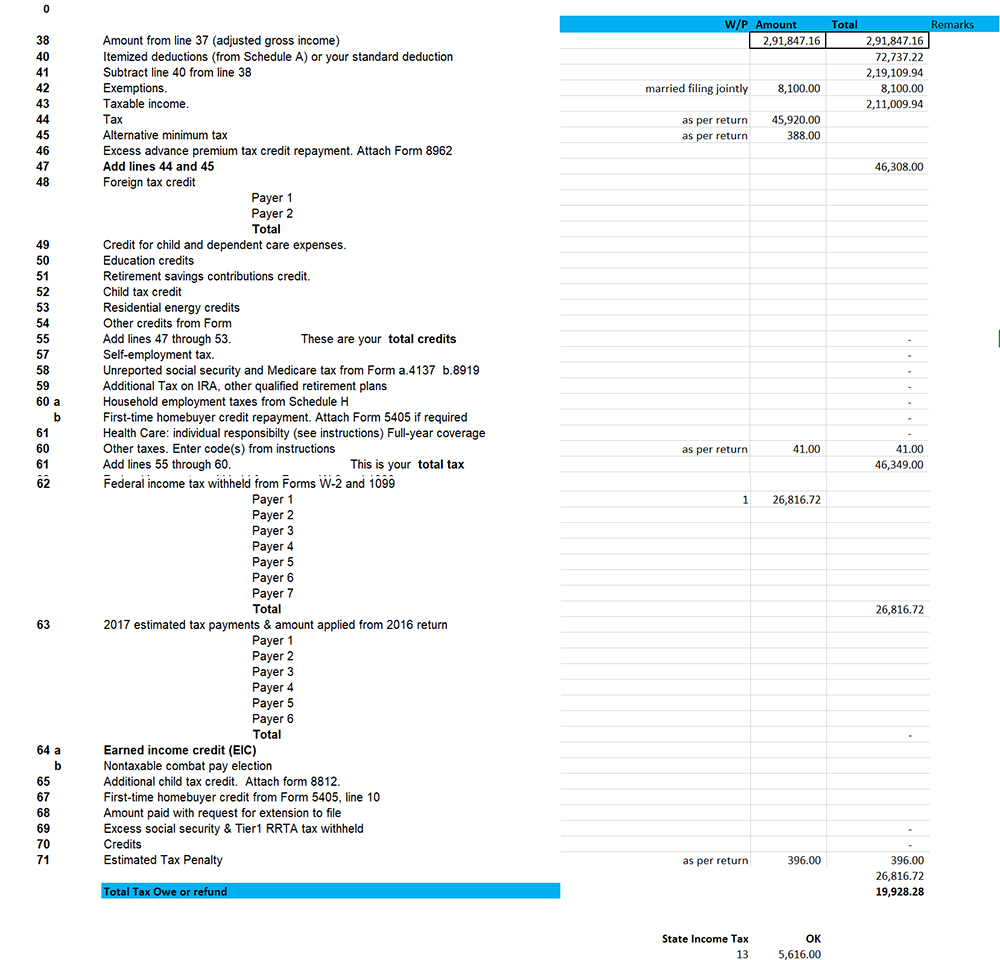

Tax

Bookkeeping

AR

Benefits of Choosing FWS for Accounts Receivable Factoring Services

Flatworld solutions is one of the leading accounts receivable factoring companies with more than 20 years of experience in offering accounts receivable factoring services. Some of the benefits of choosing FWS for accounts receivable factoring services are -

Flexible Pricing Options

We can provide you with expert accounts receivable factoring services at highly affordable prices, which are based on part-time, full-time, or pay by the hour, pay by project model, etc.

100% Information Security

Flatworld Solutions is an ISO/IEC 27001:2022 certified accounts receivable factoring company. We have the required resource capability to protect your business information from any unwarranted disruptions. Our workstations, delivery centers, and tools are secure and can safeguard your business/account from any unlikely event of safety mishap.

State-of-the-art Infrastructure

Our accounts receivable factoring support executives have access to state-of-the-art systems, tools, and technologies. They can provide their support service as expected and with the pace you want. Our offices have Telco-grade data center, FM200 fire protection & prevention system, multi-levels of redundancy for the local connectivity, etc.

High Quality

We have established the Six-sigma procedures and best practices to improve the employees' productivity level in our organization. When you outsource accounts receivable factoring services, you can expect to significantly reduce the bad debts and increase your company's revenue through the primary charge-off.

Operational Transparency

Our accounts receivable factoring process facilitates operational transparency as we adhere to each major industry standards and evaluate each & every process and employee. We have also set up a process in which we record all our communications for the audit purpose.

Multilingual Language Support

We have a gamut of AR factoring representatives who are fluent in several languages. They can communicate with you or your customer in their preferred language.

24/7 Availability

Our team of accounts receivable factoring agents is available 24 hours a day/7 day a week. This allows them to quickly respond and provide instant support.

Experienced Team

Our hiring process is strict and comprehensive, and we recruit only the best accounts receivable factoring support executives. The overall number of support executives in our company exceeds 100 in capacity and our total management experience surpasses 100+ man-years. So, when you outsource accounts receivable factoring to us, you can rest assured to receive only the best back-office support for all your accounts receivable factoring services need.

Comprehensive Weekly/Monthly Report

We have developed our accounts receivable factoring process in such a way that will streamline the receivables and improve the cash-flow in your organization. We also provide monthly/weekly accounts receivable factoring reports that will help you find out the gap areas and make the necessary changes in your company.

Option to Scale-up

We can scale up our services when you want/need to spike the requirements. Our accounts receivable factoring services can expand your business with no extra expenses required to recruit resources or establish new infrastructure changes.

Accounts Receivable Factoring Tools We Leverage

When you outsource accounts receivable factoring services to us, we will offer you the best back-office support for all your AR factoring needs that would reduce the delinquency to a great extent. We will do this by leveraging our expertise in a few receivable funding tools. Those are -

Outsource Accounts Receivable Factoring Services to FWS

Flatworld Solutions has been a pioneer provider of accounts receivable factoring services and a series of other finance & accounting services to its global clientele. We have an extended suite of accounts receivable factoring support experts who can provide you with a better flexibility and speed to improve the cash flow and get more recoveries.

We have an in-depth understanding of US & UK accounts receivable factoring business and have offered our services to the precise requirements of several industries & verticals. We are continually evolving and modernizing our accounts receivable factoring process to deliver endless value to our clients. Get in touch with us today for reliable, efficient, and cost-effective mortgage closing support for lenders.

Our Customers

Philippines Finance and Accounting Services

Hire experienced and talented Filipino finance & accounting professionals & for your business

USA

Flatworld Solutions

116 Village Blvd, Suite 200, Princeton, NJ 08540

PHILIPPINES

Aeon Towers, J.P. Laurel Avenue, Bajada, Davao 8000

KSS Building, Buhangin Road Cor Olive Street, Davao City 8000